Faculty Spotlight - Sally Abell

Sally Abell, CFA is a lecturer in the Department of Economics. She works as a portfolio manager for Merrill Lynch and brings that experience into the classroom. You can find her teaching Financial Economics (ECO 526 and 527)!

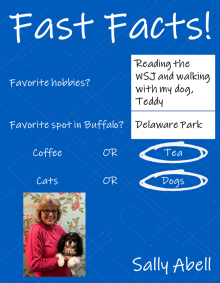

Sally Abell

How did you find your way into economics?

SA: I graduated from UB with a BS in Mechanical Engineering where I had a variety of opportunities. As a student I loved being on the board of The American Society of Mechanical Engineers where I had the opportunity to travel to the Annual Conference in San Francisco. One summer I also volunteered to tutor an Iranian graduate engineering student in English who became a lifelong friend through our shared love of tennis and travel. Another summer I had an internship at Corning Glass. Initially intimidated because the other students came from bigger name schools I relaxed when I discovered we used similar textbooks including one written by a UB professor.

After graduation, eager to travel, I took a job in a training program with General Electric in Schenectady NY, installing gas and steam turbines for The Latin America Division. The job took me quickly to Dominican Republic, Norway and Venezuela. Supervising electricians and mechanics was okay, but I found the work didn’t keep me engaged. Construction was not my skill set plus Venezuela was quite dangerous.

Home on break, I visited the man who would become my business partner and husband of 37 years (and counting). He was a stockbroker and asked me to come into his office for a week to see what he did for a living. I started reading Morningstar reports and learning about the stock market and was completely hooked. His boss was a former engineer who was intrigued by my background. I was ready and eager to move back to Buffalo, and he hired me into a training program. I studied for my Series 7 which is the preliminary certification to be become a Financial Advisor.

Having loved the content of the Series 7, I felt I would bring more value to my clients with additional training. I considered an MBA but decided that because my interests were narrowly focused on Equity and Bond Analysis, Portfolio Management and Ethics, The Chartered Financial Analyst Program was a better match. Along the way I took two accounting classes as well.

Fast Facts

What is your favorite class to teach, and why?

SA: I teach ECO 526 and ECO 527, which is Financial Economics, a nice combination of the basics of investing along with investment theory. I believe that investing is one of the most important life skills, and students will leave the class being better able to make good financial decisions for their families and employers.

What was your favorite class as an undergrad?

SA: My favorite engineering class was called Failure Analysis where we studied failed pieces of metal to understand whether the failure was caused by heat treatment problems or issues with the repetition. Upon reaching a conclusion as to the cause of failure we wrote a short paper explaining our analysis. It was a very investigative class that focused on real world problems and cause-and-effect, all aspects that are also related to economics and have helped carry my passion for economics over the years. As part of the ECO 527 class that I teach, I love that the students have a portfolio project, where they create, trade and monitor an investment portfolio. There are no better learning tools than projects with real world applications.

What are your favorite hobbies?

SA: Every morning, I feel so lucky that I have the opportunity to read The Wall Street Journal while drinking a cup of hot Earl Grey Tea. After that you will find me taking a walk near Delaware Park with my dog Teddy, before I begin my day job as a Portfolio Manager.